It's never too early to start

Whether you’re only beginning your career, getting close to retirement or anywhere in between, there is never a bad time to be planning for what’s next.For most Canadians, this means saving and investing your money so you can be comfortable in retirement. For those that own their own business, it can also mean creating a succession plan so your organization can keep going while you take time for yourself or sell your business. But regardless of where you are in life, retirement planning means setting goals and building a plan.

Retirement Planning

The most commonly used investment vehicle for retirement is the Registered Retirement Savings Plan. This is a government-approved savings option that also gives you the benefit of an immediate tax break. Because you don’t pay taxes on the funds deposited in your RRSP, you will be taxed when it’s withdrawn so it’s best to leave the money in the account until you’re ready to retire and will be taxed at a lower rate assuming you are earning less.More about RRSPs »

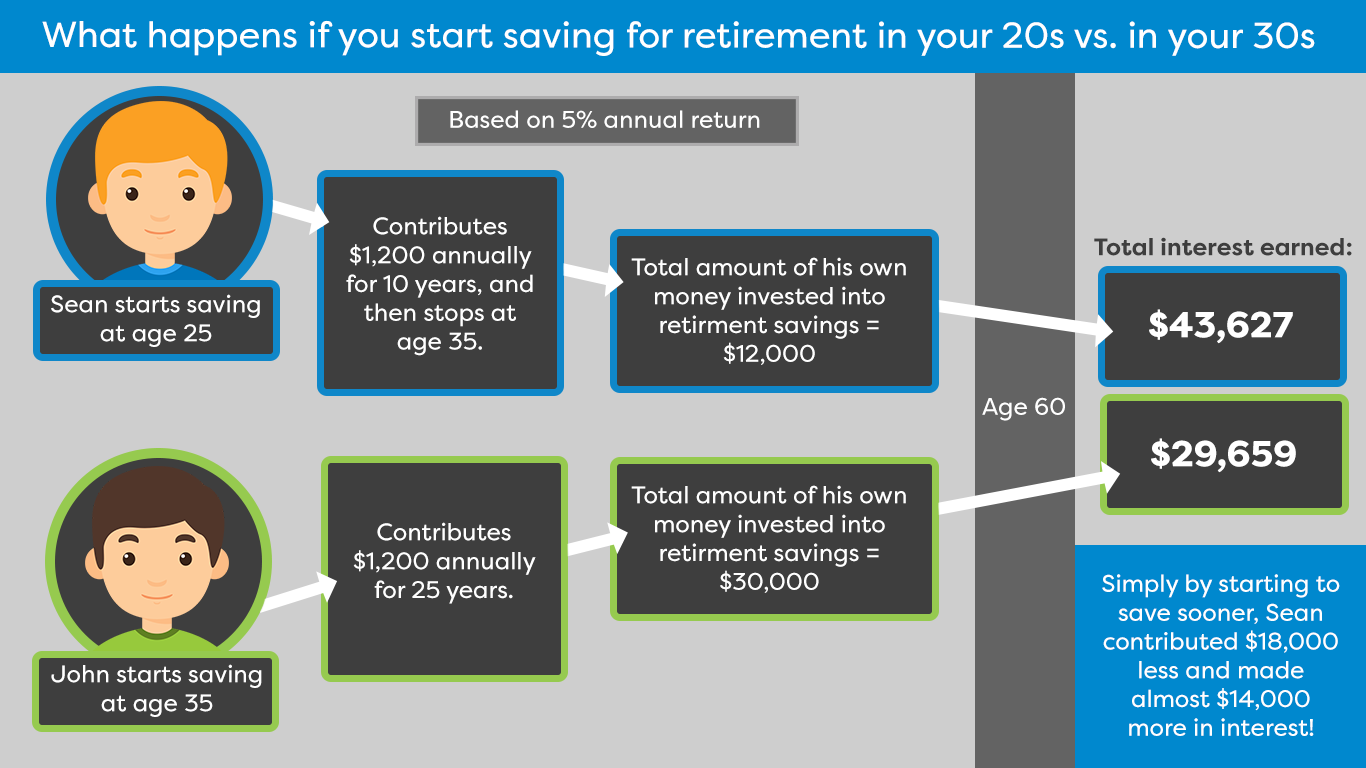

Compound Interest

When it comes to your long-term savings goals, the sooner you can start putting money away, the better. If your money earns interest, it will compound, meaning even your interest will begin earning interest, leaving you with more money in your account when it comes time to retire.

Helpful Articles

CUAuthors are experienced and financially savvy CUA staff who are passionate about helping our personal and commercial members improve their confidence and knowledge of money matters. |

|

|

| You've likely heard the term "investment" before... but do you know what it means for your financial health? Read article » | No matter what stage of business ownership you're in, it's important to have a retirement plan. Read article » | It's finally time to retire! Find out how to make the most out of your retirement savings. Read article » |

Commonly Asked Questions

Do you have questions that aren't here? Let us know!

That depends on your goals, anticipated lifestyle, current spending and savings habits and many more factors. It's important to create a retirement savings plan that works for you. To get started, check out CUA's retirement calculator to find out if you're on track.

Invest your money! While you may think of investments as high-risk, there's nothing safer than a high-interest savings account or term deposit to help grow your money. Plus, any interest earned in a Tax-Free Savings Account is non-taxable!

Start small, even if you're only able to put away $20 a pay-check, you will be surprised how quickly that adds up, especially with the help of compound interest.

If you still aren't sure how to make this work in your budget, speak with a trusted Financial Advisor. They're here to help »