The Risk of an Asterisk*

When it comes to interest rates on term deposits, the number is not always as advertised. Comparing offers and choosing one that’s in your best interest starts with three questions:

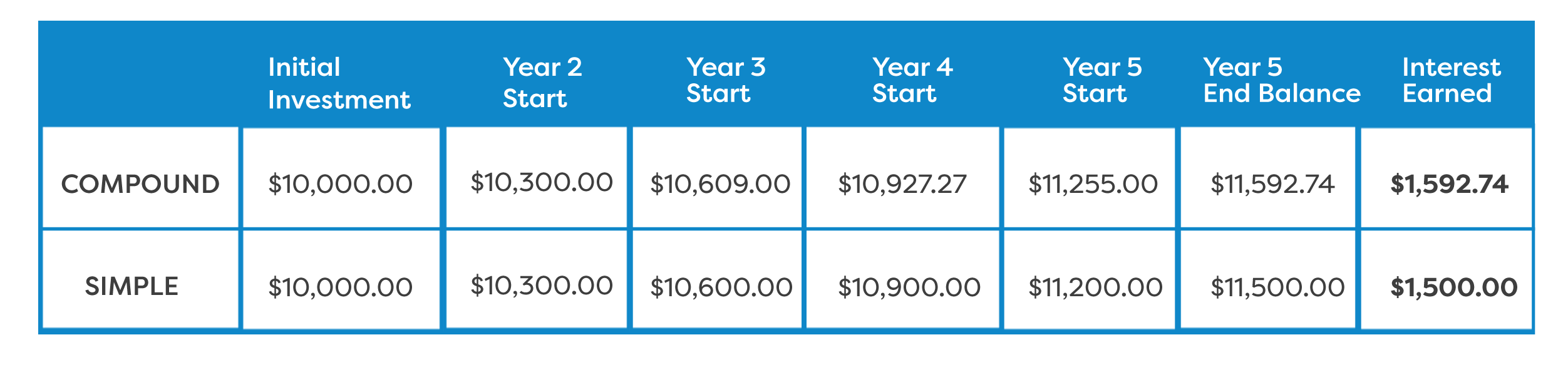

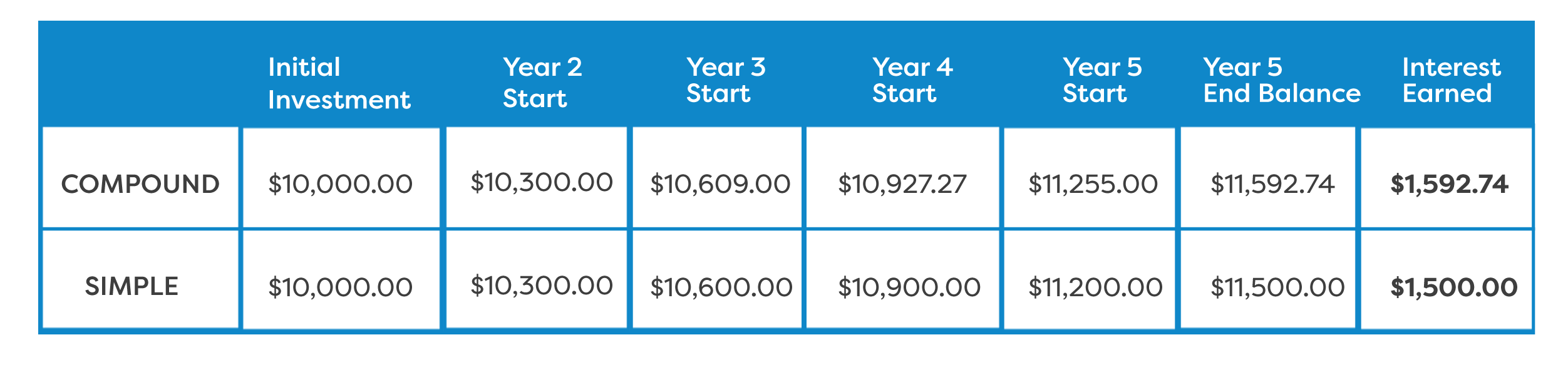

The above example looked at a $10,000 investment over a one-year term. Consider, as an alternative, this same person was comfortable locking the funds in for five years instead of 12 months. As mentioned, the advertised rate at CUA is 3.0% for a five-year term. The end balance, however, may be a surprise. The effective rate on CUA’s five-year term offering is actually 3.2% - higher than advertised. This is because you can often choose to leave the interest where it is and, by doing so, you’ll earn interest on top of interest – otherwise known as ‘compound interest.’ Letting it stay put will generate another $92.74. Bonus!

It’s never easy to compare offers in the marketplace. The most important thing to remember is that a simple symbol – an asterisk* – could cost you in the long run. With the help of CUA’s Financial Advisors, we’ll work with you to compare offers and make the choice that’s in your best interest. Let us know how we can help!

-

How flexible are the terms?

Flexibility is an important consideration when you’re tucking away money for a period of time. When life happens, accessing those funds might be required and they may not be immediately accessible, or it could be costly if the terms don’t allow you to do this without paying a hefty penalty.

-

Is there a promotional period?

Putting money away into a term deposit looks attractive when advertised at 3.2% when, in reality, that rate may drop down after a short period of time, leaving you with less than you had hoped at the finish line. For example, a one-year term may have a promotional rate of 3.2% for the first 60 days, and a regular rate of 1.75% for the remaining 305 days of the year. You may think you have the promotional rate locked in for the whole term when you’re actually earning the lower rate for the majority of the term, after the promotional period ends. -

How much will you have at the end of your term?

This one is the most important, and requires you to know how the interest is being calculated over the term of the deposit. In the example provided in #2 above, an initial $10,000 investment can be expected to generate $52.60 in interest during the 60 day promotional period (3.2% rate), however, after the rate drops it will earn only $147.00 for the remaining 10 months (1.75% rate). Knowing what your initial deposit will look like at the end of the term enables you to determine the “Effective Interest Rate,” or the average interest rate paid out over the term. In many cases, this will end up being lower than the advertised rate. Here’s why: in this example, the initial $10,000 investment will cross the one-year term finish line at a total value of $10,199.60. The effective rate is calculated by dividing the total interest earned ($199.60) by the number of dollars invested ($10,000), resulting in an effective rate of 2% - much lower than the advertised rate of 3.2%.

The above example looked at a $10,000 investment over a one-year term. Consider, as an alternative, this same person was comfortable locking the funds in for five years instead of 12 months. As mentioned, the advertised rate at CUA is 3.0% for a five-year term. The end balance, however, may be a surprise. The effective rate on CUA’s five-year term offering is actually 3.2% - higher than advertised. This is because you can often choose to leave the interest where it is and, by doing so, you’ll earn interest on top of interest – otherwise known as ‘compound interest.’ Letting it stay put will generate another $92.74. Bonus!

It’s never easy to compare offers in the marketplace. The most important thing to remember is that a simple symbol – an asterisk* – could cost you in the long run. With the help of CUA’s Financial Advisors, we’ll work with you to compare offers and make the choice that’s in your best interest. Let us know how we can help!

Revised Jul. 6, 2022