Save today. Enjoy tomorrow.

No matter what your financial goals are, there is an investment solution to meet your needs and help you grow your money. The best time to start investing is as soon as you can, as the longer you have your money working for you, the more earning potential you have.Here we'll cover everything you need to know to get started:

The Difference Between Saving and Investing

When it comes to saving and investing, many people use these terms interchangeably, but a good rule of thumb is to use easily accessible savings accounts for your short-term goals, such as saving for a major purchase and invest when you have time for your money to grow, like with your long-term goals, which could be your retirement or child's education.Savings are better suited for a day-to-day savings account or TFSA, so that you can hold the money in cash or other short-term investments and have it readily accessible when you need it, especially in the case of an emergency fund.

An investment, as it relates to money, is a contribution to a financial product that will provide a financial return in the future. This means setting some of your money aside in a designated place for a set amount of time so that it can earn you additional income to help you achieve future goals:

- Be able to retire when you want to

- Have funds saved for your children's education

- Become more financially secure.

Your Investment Strategy

Your investment strategy will be made up from a couple of different components. The first thing you need to do is consider is your goals. Depending on your goals, you will determine how long you have to save and how much and from there you can create your investment strategy.Goals will vary from person to person but a few common ones include:

- Buying a home

- Paying for child's education

- Going on a special vacation

- Buying a new car

- Retiring

An investment vehicle is a type of account that holds your investments. You choose different accounts for different savings goals. Common choices include:

- Tax-Free Savings Account - Contributing to a TFSA is a great way to save for the short or long-term. It could be used for your emergency savings, vacation fund, and many Canadians use TFSAs as a part of their retirement planning as well. As the name suggests, you can withdraw your investment returns tax-free.

- Registered Retirement Savings Plan - Contributing to an RRSP allows you to reduce your taxable income for the year you make the contributions and in the first 60 days of the next calendar year. As the funds are withdrawn from an RRSP, they are included in your income and will be taxed. When you begin withdrawing money once you’ve retired and are likely earning a smaller income, you will be taxed in a lower tax bracket than if you had accessed the funds during your earning years. While an RRSP is primarily intended for long-term saving, funds can be withdrawn to be used as the down payment on your first home or paying for continued education without being considered as part of your income.

- Registered Education Savings Plan - Contributing to an RESP helps save for a child in your life who has big dreams of getting a post-secondary education. An RESP allows you to earn interest, tax-free and receive grants from the government that match your contributions, up to 20% on the first $2,500 you deposit annually. For example, if you can contribute $2,500 a year in your child’s account, the Government contribution will be $500 a year.

Investment products

|

Investments that pay you a fixed rate of return over a fixed period of time with a guarantee that the original amount you deposit as an investment will not decrease. |

|

|

|

The Power of Compound Interest

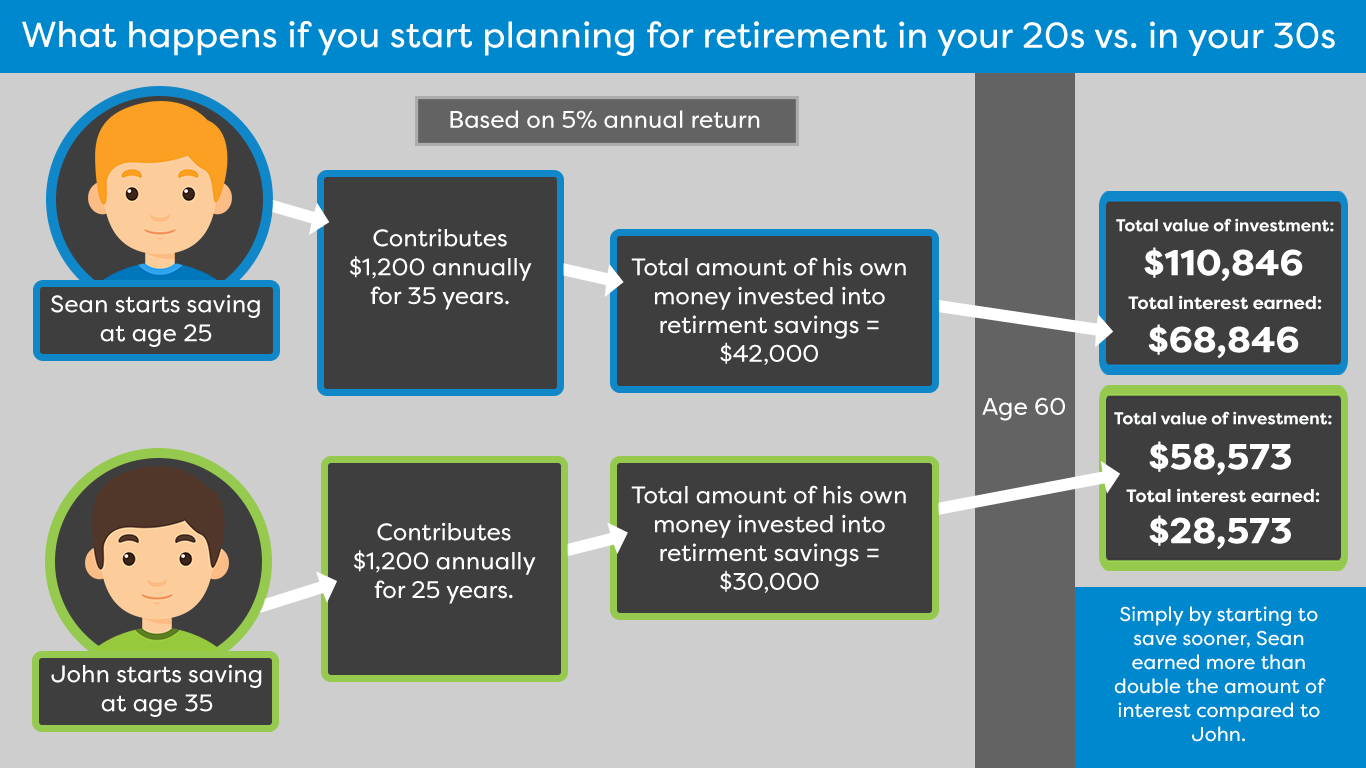

Investing your money using a product that offers compound interest means that the longer you leave your money to grow, even your earned interest will begin earning interest.In the example below, you can see how both Sean and John benefitted from compound interest, but the longer you can leave your money to grow, the better off you'll be in the long run.

Getting Started

Think you're ready to start investing? Consider these things before you do:- Do you have debt? If so, consider these tips for getting out of debt »

- Do you have an emergency fund? Be prepared for life's surprises »

- Do you want to work with an advisor or take a DIY approach? Get started »