Making Your First Home a Reality

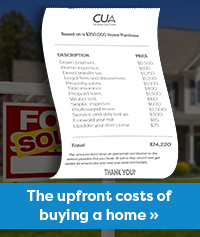

For many Canadians, home ownership feels out of reach. In Nova Scotia, the cost of living already makes it difficult to save, with forecasters predicting the average price of a home to increase by six percent in 2024 to over $432,000. As such, buying your first home might feel like a dream rather than a goal. If this sounds familiar, the recently introduced First Home Savings Account (FHSA) could be the tool to help you save for your first home. In this article, we’ll explore how the First Home Savings Account works, and how it combines the tax-deductible benefits of a Registered Retirement Savings Plan (RRSP) with the tax-free withdrawals of a Tax-Free Savings Account (TFSA) to help make your home ownership dreams a reality.

What is an FHSA?

The FHSA was introduced by the Federal Government in order to help Canadians to save for their first home. It’s a tax-free savings option designed specifically for first-time home buyers. Qualifying withdrawals made from this account can be used towards your down payment, building your new home, or doing renovations.

What are the benefits?

With a FHSA, your contributions are tax-free up to $40,000. Any investment income you earn on these contributions is also tax-free. Additionally, when it’s time to file your taxes, you’ll see that the contributions you’ve made to your FHSA will reduce your taxable income, and therefore decreased the amount you’ll have to pay in taxes, saving you even more money.

Another benefit is that you can use both the Home Buyers’ Plan (HBP) and the FHSA on the same qualifying first home purchase. Unlike the HBP, which allows you to withdraw money from your RRSP to put towards your first home, you don’t need to pay back any FHSA funds used on your purchase. With up to $40,000 in the FHSA and up to $35,000 through the HBP, you could have upwards of $75,000, plus interest within the FHSA, towards your first home purchase.

How does it work?

There is no minimum amount you need to contribute to your FHSA, however the maximum amount you can contribute is $8,000 each year, up to a total of $40,000 over 15 years. You’re eligible to open an FHSA if you are a resident of Canada, at least 19 years old, which is the age of majority in Nova Scotia, and are a first-time home buyer. Your FHSA account will expire on December 31st of the year in which the earliest of the following occurs:

- The year following the year you make your first qualifying withdrawal.

- The 15th anniversary of opening the account.

- The year you turn 71.

Your FHSA can hold money, term deposits, or guaranteed investment certificates (GICs), making it a solid investment vehicle to grow your savings.

What happens with unused funds?

In the event that you don’t buy a home with savings from your FHSA, or if you have funds left over, they can be withdrawn and taxed as income, or transferred to either an RRSP or a Registered Retirement Income Fund (RRIF) without requiring or using RRSP contribution room. Remember that tax-free withdrawals apply to qualifying withdrawals only, as defined by the Canada Revenue Agency.

How does transferring funds work?

You can transfer funds out of your FHSA into an RRSP or an RRIF. Similarly, you can transfer funds from your RRSP to your FHSA tax-free. If you have a TFSA, you won’t be able to make direct transfers into your FHSA. Instead, you can withdraw funds from your TFSA and then deposit them into your FHSA.

Can I share my account with my spouse?

While you cannot share a joint FHSA with your spouse, you can open separate accounts, each contribute independently, and use these contributions together towards your first home. This means that your combined contribution limit with your spouse will effectively double your potential savings towards a first home.

What’s the catch?

Some things sound too good to be true, but when it comes to the FHSA, rest assured that it’s designed to make purchasing your first home attainable with no strings attached. Our team at CUA understands that home ownership still feels out of reach for many. It’s important not to disqualify yourself out of fear that you’ll never save enough. With the right tools, time, and guidance from a Financial Advisor, saving can be made manageable.

If you have any questions about the FHSA, or one of our mortgage or loan products, please reach out to a member of our team at 902.492.6500, by booking an appointment or emailing info@cua.com.

Published Nov. 8, 2023