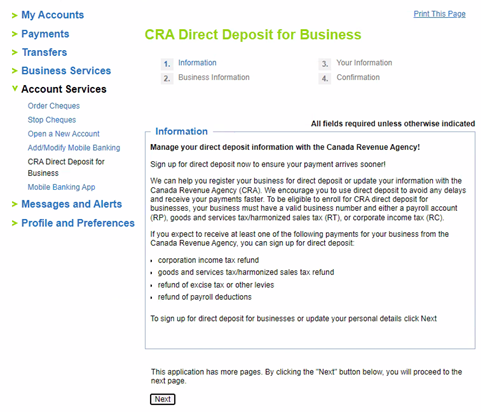

CRA Direct Deposit for Businesses

CRA’s Direct Deposit is a fast, convenient and secure way to receive your payments or refunds for your business. Registration takes less than five minutes from login to completion, and it will enable CRA to deposit your funds directly into your CUA account. A number of payments and refunds are available for Direct Deposit, including:

- corporation income tax refund

- goods and services tax/harmonized sales tax refund

- refund of excise tax or other levies

- refund of payroll deductions

- RT – Goods and Services Tax/Harmonized Sales Tax

- RP – Payroll

- RC – Corporate Income Tax

- Sign into online banking at cua.com.

- From the left-hand menu, select Account Services and then Set Up CRA Direct Deposit for Business.

- Follow the prompts, entering your CRA Business Number with either Payroll (RP), Goods and Services Tax/Harmonized Sales Tax (RT), or Corporate Income Tax (RC) and select the account you would like deposited. You will then confirm the information of the owner, director, partner or other corporate officer of the business and proceed to the next page.

- On the next page, you will confirm your information and consent to submitting your information.

- Review your information to ensure everything is correct, select Submit and you’re finished!

Frequently Asked Questions

If you are already registered for CRA Direct Deposit, you don’t need to register again.

Yes. You can sign up directly with the CRA if you prefer.

No, once you are registered once, you are enrolled for any and all types of government payments that you may be eligible for.

You can contact CRA directly, toll-free, at 1-800-959-8281.

Yes, visit CUA’s Personal Banking page to learn how.

Yes. The most recent enrolment you complete will become the account on file with CRA.