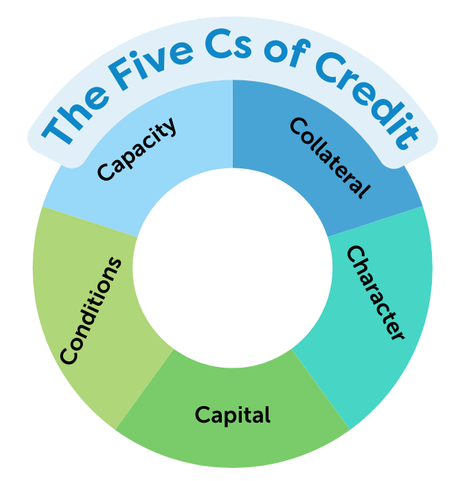

The Five Cs of Credit

When an individual or a business applies for a loan (called "credit" in the banking world), there are several things that a lender will consider before deciding whether to approve the request. The lender will typically follow what is called the Five Cs of Credit: Character, Capacity, Capital, Collateral and Conditions. Examining each of these things helps the lender determine the level of risk associated with providing the borrower with the requested funds. Read more on the breakdown of each C below:

When an individual or a business applies for a loan (called "credit" in the banking world), there are several things that a lender will consider before deciding whether to approve the request. The lender will typically follow what is called the Five Cs of Credit: Character, Capacity, Capital, Collateral and Conditions. Examining each of these things helps the lender determine the level of risk associated with providing the borrower with the requested funds. Read more on the breakdown of each C below:

1. Character – Character is reflected in the banking consumer's level of responsibility and willingness to meet their obligations. In a lending scenario, your character is strongly weighted by your credit report. Your credit report is a detailed report outlining your credit history, including any loans you have had, credit cards and more. The report shows how you have handled credit in the past and is used to predict how you may handle it in the future. It is also used to generate your

2. Capacity – Capacity is determined by a number of factors:

-

Sources of income- Are you salaried, commission based, self-employed or a seasonal worker?

-

Stability of income- How long have you been at your job and is your employer a new business or are they well established?

-

Total Debt Service Ratio (TDSR)- TDSR is calculated by adding together your mortgage or rental payments, property taxes and all other debt payments (credit cards, loans, lines of credit, etc). The sum of all debt payments is then divided by your gross income. Typically, a lender will look at 40% TDSR as the maximum level.

When the lender looks at your income sources, stability and TDSR, they can determine your capacity to pay back a loan.

3. Capital – Lenders like to see the borrower investing their own capital into a project, as it shows a seriousness about the investment. A great example of this is having a down payment in order to secure a mortgage. Net worth is another good way to determine capital. Your net worth is determined by comparing the value of what you own to what you owe. A high net worth indicates stability and also good savings or budgeting habits.

4. Collateral – Sometimes when you apply for a loan, you have the option to offer collateral as a way to strengthen the application. This means that, in the instance you aren't able to repay your loan, the lender can repossess the collateral as payment. This could be your home, a vehicle, other assets or whatever you have negotiated with the lender. Providing collateral can also reduce the interest rate on the loan, as it reduces the risk to the lender.

5. Conditions – The conditions of your loan are also considered before it is granted. This includes the interest rate, the repayment term, the amount and the purpose of the money. If a lender knows the money is intended for a specific purpose, they may be more likely to approve your request than if you are applying for a loan just to have the available credit.

What’s the big deal about credit?

What’s the big deal about credit?

Simply put, good credit can mean the difference between purchasing your dream home and continuing to rent for another year. With good credit, you are more likely to get approval for loans and may qualify for lower interest rates and better lending terms than individuals with poor credit. This makes big purchases like vehicle financing and home ownership more affordable, while individuals with poor credit will have greater difficulty qualifying for loans and may have to provide a higher down payment or have a higher interest rate.

Your credit history begins when you borrow, or apply to borrow, money for the first time. This could be a credit card application, a loan from a bank or even a new cell phone contract. Your credit history is accessed through two credit bureaus in Canada, Equifax and TransUnion. These bureaus retain information on your credit history and when you apply for a loan, lenders will access this data, which is called your credit report. Your credit report determines how well you manage money, and your financial risk for loan repayment.

The Bank of Canada recommends checking your credit score at least once a year. You can have your credit report sent to you by mail or you can access it online free of charge.

If you’re interested in learning more about the Five Cs of Credit, what it means for you when applying for a loan or have any other questions related to being approved for financing, one of our Financial Advisors or Commercial Team Members would be more than happy to talk to you. You can connect with someone by calling 902.492.6500 or emailing info@cua.com.

Search

Search

www.google.com

www.google.com